1. Which documents require mandatory registration?

Registration of documents acts as a notice to the world at large that the rights, interest or title of the property therein mentioned have been transferred to another person.

Mandatory Registration- The Registration Act enlists the instruments which shall be registered, under Section 17, that are as follows:

Mandatory Registration- The Registration Act enlists the instruments which shall be registered, under Section 17, that are as follows:

- Gift of immovable property;

- Non-testamentary instruments above the value of 100Rs. creating or declaring any right, title or interest. For example- an exchange or relinquishment deed;

- Non-testamentary instruments acknowledging receipt or payment of consideration which creates or declares any right, title or interest;

- Leases for immovable property from year to year or for term exceeding one year or reserving yearly rent;

- Non-testamentary instruments transferring or assigning any decree or order of a court creating or declaring right, title or interest of value of 100Rs. or upwards;

- Contracts to transfer for consideration any immovable property for the purpose of Section-53A of Transfer of Property Act shall be registered.

When clauses (b) & (c) mentioned above are read together because they talk about creation, declaration of same rights, titles or interests. However, there has been recommendation made by the 34th law commission report in 1967 to omit clause (c) from Section-17. The ground of such recommendation was that receipts are not required to be registered. The recommendations were not accepted and the clause continues to be a part of The Registration Act.

2. Which documents are optionally registrable?

Registration is important so that genuineness and authenticity of the document can be easily ascertained. Even if a document is optionally registrable, it is better to register it so that it becomes a part of public record. Though non-registration doesn’t affect the validity or admissibility of the document in the court of law. Optionally Registrable documents as given under Section–18 are as follows-

- Instruments which operate to create or declare right, title or interest of value less than 100Rs.;

- Leases of immovable property for term not exceeding one year;

- Instrument transferring, assigning any decree or order of court or any award of value less than 100Rs;

- Instruments which create or declare any right, title or interest to or in movable property;

- Wills;

- Other documents not required by Section-17 to be registered.

3. Which documents are not required to be registered?

Following are the documents which do not require registration-

- Composition deed; or

- Shares in joint stock company; or

- Debentures issued by any company; or

- grant of immovable property by government; or

- instrument of partition made by revenue officer; or

- order granting loan under the Agriculturist’s Loans Act and Land Improvements Act; or

- order of vesting property in treasurer or charitable endowments.

4. What if such document contains any interlineation, blanks, erasure or alterations?

According to the mandate of Section-20 of The Registration Act, 1908, registering officer may in his discretion refuse to accept the document for registration. However, if the executor attests the document with signature or initials such interlineation, blank, erasures and alterations, then they may be accepted for registration. It is a mandate for registering officer to make notes in register of such interlineation, blank, erasures and alteration.

5. What are the requirements for documents to be registered?

In accordance with Section-21 & 22, document shall be accepted for registration only upon fulfilling the following conditions-

- Description of such property sufficient to identify it.

- Houses of town to be described as situated on north or other side of street or road to which they front and by their former occupancies.

- Other houses and lands shall be described by their name and by reference to government map or survey.

- Non-testamentary documentary shall not be accepted for registration unless accompanied by true copy of map or plan.

- If not practicable to describe the house by maps or surveys of government, for the purposes of Section-21, shall be so described in other manner.

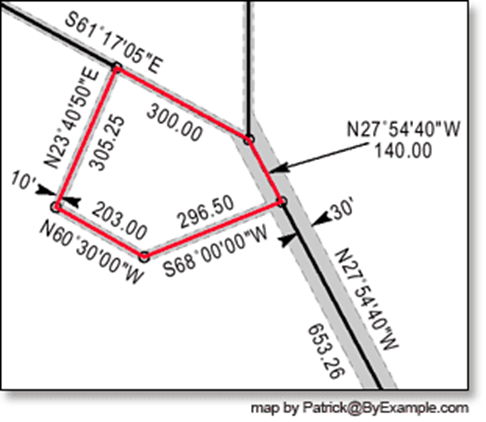

For example-

(The image has been used for illustration purposes only)

6. What is the time for presenting a document for registration? Does law grant any immunity with regards to time in which a document should be presented for registration?

Section-23 of the Act requires that document shall be presented for registration within four months from the date of its execution. An exception has been created for the wills. However as mentioned in the article, wills are optionally registrable. And copy of decree or order shall be presented within 4 months of the date on which decree or order was made.

Section-25 of the Act provides immunity in case of urgent necessity or unavoidable accidents, i.e. the act provides another 4 months period in which registrar may on payment of 10 times the amount of proper registration fee shall accept the document for registration.

| Within 4 months of execution |

| If urgent necessity, further 4 months provided. (on payment of 10x fees) |

7. Where should a document of a land be brought for registration?

Section-28 requires that the documents shall be presented for registration in the office of sub-registrar within whose sub-district the whole or some portion of property is situated. Generally, a document shall be registered at the office of officer authorized to accept the same for registration. However, on special cause being shown under Section-31, the officer may attend at the residence of any person to present a document for registration or to deposit a will.

8. Who can present a document for registration except the executor?

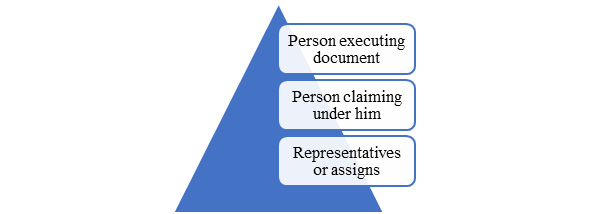

In accordance with Section 32 of the Act, a person executing document or any person claiming under him or any representative or assign of such person or the agent of such person may present the document for registration.

The person who presents such document shall affix his photograph and fingerprint on the document. However, if the document is with regards to the transfer of ownership of immovable property, then photograph and fingerprints of both buyer and seller shall be affixed.

9. Can registrar refuse to register the document?

Yes, a registrar can refuse to register a document if the person by whom it purported to have been executed, denies the execution of the document or if the person appears to be a minor, idiotic or lunatic to the registrar or if the person by whom it is purported to be executed is dead and his representative denies the execution.

Every sub-registrar refusing to register a document shall make an order of refusal and record his reasons. However, if the property is not situated within his sub-district, then above-mentioned condition is not material.

10. What if you don’t follow the mandate of the law to compulsorily register a document?

Section-49 of the Act provides the effects of non-registration of a document which are as follows:

- It does not affect any immovable property.

- It does not confer any power to adopt

- It cannot be received as evidence of any transaction affecting such property.

Exceptions have been created which are as follows:

- Document affecting immovable property and required by this act or Transfer of Property Act to be registered may be received as evidence of contract in suit for specific performance.

- Evidence of any collateral transaction not required to be effected by registered instrument.

In S. Kaladevi v. V.R. Somasundaram, AIR 2010 SC 1654, it was held by hon’ble Supreme Court that an unregistered sale deed can be accepted in proof as evidence for the oral agreement of sale rather than complete sale. The hon’ble court also held that an unregistered sale deed can be admitted as evidence in specific performance suits.

The registered document shall take effect from the date of execution and not from the date of registration.

10. Is electronic registration of the document possible in India?

Ensuring accessibility and convenience to the citizens of India, e- registration of documents is taking place as a part of ‘Digital India’ initiative of government of India. Electronic signature can be affixed on the document and later stamp duty can also be filed with an online transaction. Thereafter, a consolidated record can be found on the government portals. For reader’s convenience, the link has been attached below.

https://dolr.gov.in/national-generic-document-registration-system

11. What if you make false statements in the document?

Section- 82 of the Act penalizes the act of making false statement, false personation, delivering false copy or translation of document or false copy of map or plan or the abetment thereof. There is a punishment of 7 years or fine or both for the commission of the said act.

12. What is effect of refusal of sub-registrar to register the document?

Except where denial is due to refusal to execution, an appeal can be filed to the registrar within a period of 30 days from the date of the order and registrar can reverse the order

References

Gift– Refer Section-122 of Transfer of Property Act, 1872

Exchange– Refer Section 118 of Transfer of Property Act, 1872

Relinquishment deed– Transfer of ownership by one co-owner to another co-owner of the property. (Usually without monetary consideration between the family members)

Interlineation– Adding any lines to the document after registration (mainly for the purposes of adding clarity to the instrument)

Composition deed- Compromise deed

Execution– Signing or affixing thumb impression

Testator– One who makes the will